As I have explained in previous posts, credit cards have a large variety of benefits over debit cards and other methods of payments, such as credit profile building, warranty extension, delayed payment, and emergency fund. Apart from APR’s, credit cards are more or less the same with respect to most benefits. And of course, you should never carry a balance because a low credit card APR is still a ridiculously high interest rate. How, then, do you decide what credit cards to obtain?

Well, how about rewards, the most prominent feature of credit cards that are advertised these days on TV and newspapers, as well as brick-and-mortar banking locations? 1% cash back on every purchase. 5 points per dollar spent on honey. 2 miles per dollar spent on US Airways flights. I’m sure you’re familiar with these commercials already. What’s confusing about these reward systems is that they use different types of currencies which are sometimes hard to evaluate. I will attempt to decipher the most common credit card currency types for you below.

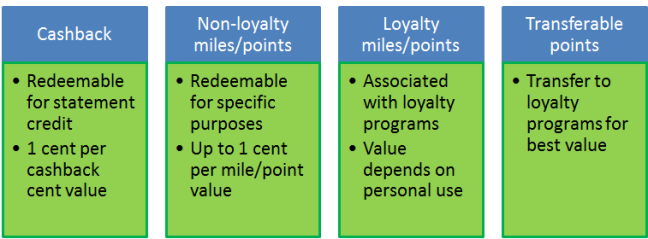

There are 4 main categories of reward currencies: cashback, non-loyalty miles/points, loyalty miles/points, and transferable points in the order of decreasing straightforwardness and increasing complicatedness.

I. Cashback is simply a rebate on purchases, and can be redeemed as statement credit. Take the BankAmericard Cash Rewards card as an example: this card offers you 3% rebate on gas, 2% on groceries, and 1% on everything else. I can redeem the cashback for statement credit, but if I instead deposit my cashback to my Bank of America checking account, I get a bonus of 10% on the rebate, meaning I effectively get 3.3%, 2.2% and 1.1% depending on the category of purchases.

Examples of this type include the Chase Freedom and the Discover More/It. The Discover More/It also allows you to use the cashback to purchase partner stores’ gift cards at a discount, which makes its cashback cent more valuable than the USD cent.

II. Non-loyalty miles and points are more complicated. I say “non-loyalty” to distinguish these miles/points from those supported by hotels or airlines loyalty programs, which actually belong to the third category. For these miles/points, you can only redeem them for specific purposes. For example, the BankAmericard Travel Rewards allows you to redeem the points for statement credit on travel expenses at a 1 cent-per-point (cpp) ratio. This card gives me 1.5 points per purchase dollar, and a 10% bonus on that since I bank with BofA, for a total of 1.65 points per purchase dollar. Since I do travel quite a bit, this is as good as 1.65% cashback. You can also redeem these points for merchandise from BofA’s Travel store, but the redemption ratio is not worth mentioning. Travel reward points should be redeems on travel expenses for the best value.

Capital One Venture, another travel rewards card, gives you 2 points, which they actually call “miles”, per purchase dollar which can be redeemed for 2 cents toward statement credit on travel expenses, similarly to the BofA Travel Reward card. Citi’s Thank You points, which can be earned from many Citi cards, can be redeemed for certain stores’ gift cards at a 1 cpp (cent-per-point) ratio, and lower for others.

III. Loyalty miles/points comprise an interesting category, since it’s difficult to evaluate the rewards. If you never fly American Airlines, American Airlines points are about worthless. If you never stay at a Hilton, Hilton HHonors points are worthless unless you transfer the points to airlines partners, and then if you don’t fly with these partners the points have zero value. If you fly all major airlines, then which airlines’ points are worth the most to you?

For airlines’ points, I suggest you visit MileValue’s Leaderboard at: http://milevalue.com/mile-value-leaderboard/

Scott Grimmer does a good job explaining and implementing his valuation methodology for different airlines. From the chart, you can see that US Airways’ Dividend Miles are worth almost 2 cents per mile, and therefore the Barclays’ US Airways credit card gives you a higher return than a credit card that gives you 1% cashback on everything. A big caveat is that you have to know that you want to fly US Airways to make their miles worth that much. On the other hand, if you want to fly to Europe on Business class, US Airways’ miles are worth a lot more than 2 cents per mile.

For hotel points, I have found One Mile At A Time helpful: http://boardingarea.com/blogs/onemileatatime/2012/06/11/my-updated-analysis-on-what-a-milepoint-is-worth-hotel-points/ I usually do not stay at hotels unless the stays are free, but if you find yourself paying out-of-pocket for hotel stays along your travels, it may be worth your time to consider hotel credit cards. The caveat is the same as for airlines points: you have to stay at the designated hotels to make the points worth, unless the hotel loyal program allows you to transfer the points for miles with airlines partners.

IV. Transferable points.There are a few credit cards out there that give you reward points that can be transferred to loyalty programs. For example, certain Amex-issued cards such as the Premier Rewards Gold lets you earned Membership Rewards points transferable to Delta Airlines and some other airlines’ loyalty programs at a 1:1 ratio, and sometimes even higher with random transfer bonus promotions.

For cards that have transferable points, always transfer the points to the most useful loyalty programs, usually frequent flier programs since they offer the best value of your points. Usually you can redeem the points for statement credit, but that would be a waste of the points’ transferability feature. Any airlines mile is worth more than 1 cent per mile, whereas if you redeem the points for statement credit or anything else you’ll get only 1 cent per point.

To summarize the 4 currencies:

The aforementioned classification covers just about every rewards credit card on the market. Some products are hybrids, allowing you to redeem your miles/points in a variety of ways, but you can easily detect the one way that gives you the best value since it’s the original purpose of the rewards program.

Perhaps the most important distinction to make between these 4 categories is that between loyal miles/points and non-loyalty miles/points. Originally, miles referred to frequent flier miles of course, but over time credit card issuers started using the term to refer to reward points redeemable for travel expenses and thus disguised the true cashback-like nature of the rewards system. Make sure you understand the value of the rewards and don’t count on the wording which could be vague.

Knowing the value of credit card rewards will help you select cards to apply for that satisfy your needs for rewards and align with your spending patterns. My 9 credit cards are all reward cards, and I will analyze them in future posts to illustrate further the differences between rewards programs.

Hope you all enjoy the long weekend!

Best,

Richard

I don’t know if I agree with your logic on credit cards….

How so, Amy?

Hi Richard,

I dont understand the differences between Thank You Points card and credit card at Citi , as well as Cash Reward and Travel Reward card at BankofAmerica?? How is the credit transfered into cash as it is credit??? I hope you get my point.

Hi Tusen,

Thank You cards are a collection of credit cards offered by Citi that reward in Thank You points which are non-loyalty points.

BankAmericard Cash Rewards reward you in cashback, and BankAmericard Travel Rewards reward you in non-loyalty miles.

When you redeem points for statement credit, the points become cash. Let me know if you are still confused.

Now I understand it! Thank you for explaining.