2 months ago, I posted an article explaining the driving force behind the stock price movement of AMR Corporation, the mother company of American Airlines, since the American Airlines – US Airways merger was announced in February, 2013.

In light of the merger getting closer and closer and more detail being released, I wanted to write a quick follow-up on that popular post.

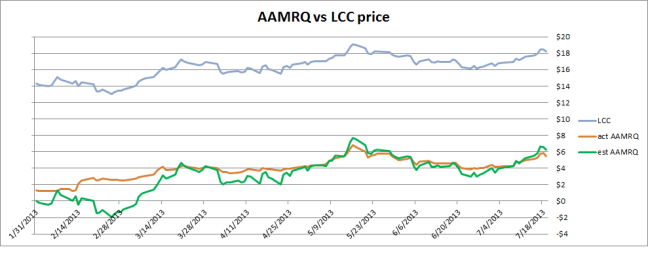

First off, how did my formula to determine AAMRQ stock price based on LCC stock price turn out to be? I have updated the chart tracking the price movement of these 2 stocks. See for yourself how close the AAMRQ estimate is to the actual.

If you recall, I based my formula: AAMRQ = LCC * 1.582 – 22.56 on several numbers provided by Jamie Baker from JP Morgan. While the number of shares outstanding is easy to confirm, the total claims from AMR Corporation’s creditors is hard to estimate. Apart from the $7.565 b figure from JP Morgan, I have not had much success finding a reliable estimate for the total amount of debt to be paid out to these creditors. According to Tulsa World, the amount is $7.68 b. http://www.tulsaworld.com/continuing/coverage.aspx/American_Airlines/34

Unfortunately I could not locate any document filed on April 16, 2013 that reports the quoted amount. My search on sec.gov wasn’t fruitful. If you have the time to go through http://www.sec.gov/cgi-bin/browse-edgar?action=getcompany&CIK=0000006201&type=&dateb=&owner=exclude&start=120&count=40 , feel free to give it a try.

I was about to give up when I recalled that a couple of weeks earlier AMR Corp had sent me a CD containing documents related to the merger case. As a stockholder, I get to vote on the deal – that’s why they sent me these documents. I still have a bunch of paperwork to file by July 27, 2013 which I suppose is the cutoff date for voting. Treasure hunting through thousands of pages led me to the official estimate from the proposed Plan of Reorganization. If you have the Disclosure Statement dated June 5, 2013, it’s on page 486 out of 510 pages. The estimate is $7.699 b. Under this assumption, my calculation has a little bit of revision:

AAMRQ=(72%*736.8*LCC-7699)/335.3

AAMRQ=1.582*LCC – 22.96

The formula based on JP Morgan’s estimate was AAMRQ = 1.582*LCC – 22.56

So the revised formula gives AAMRQ a 40 cents lower price.

How significant is the difference? Well, 40 cents is quite a big deal given that AAMRQ price is in the $5-$6 range. However, the debt amounts from JP Morgan and AMR Corp are both estimates, and estimates are based on many assumptions, the most significant being how the claims will be settled and the market value of the claims at settlement date. Being a pension actuary, I am quite confident that the pension liability will be off, maybe way off, depending on the interest rate, the negotiation with the Pension Benefit Guaranty Corporation, and the timing of the plan participants’ retirement.

That said, however, given the uncertainties in the merger, I would rather be conservative with any AAMRQ purchase. Since the new estimate results in a lower AAMRQ stock price, I will pick this new estimate to evaluate AAMRQ.

AAMRQ=1.582*LCC – 22.96

I still find this stock valuation case interesting, and may write further on AAMRQ or LCC in the next couple of months, especially if some unforeseen event happens to the merger. But as of now, I have greater interest in Nokia, so you can expect more posts on this Finnish handset manufacturer.

Best,

Richard (Hiep Tran)

I found LCC oustanding shares are 192 M on CNBC. The total value of the merged company should be LCC value/28% and the value of the AMR part should be LCC value/28% * 72%

Not sure why you used LCC shares of 736.8M.

Did I make a mistake here?

Hi Bill,

You are correct in saying that US Airways Group has 192M shares outstanding. 736.8M is the proforma number of shares outstanding in the new company. It is JP Morgan’s estimate, and is roughly equal to the number of LCC shares outstanding divided by 28% which is US Airways’ share in the new company.

Thanks for the information.

192M/28% = 685.7M, ~7% lower than the 736.8M number. This difference can lead to big difference in projecting future AMR stock fair price.

736.8M is a proforma number, which serves as an estimate and is not intended to be the exact figure. The calculation to arrive at this number is complicated and involves the valuation of AMR Corp. And since the merger hasn’t closed yet, only an estimation can be performed. If you have a better estimate, please share with us.

Hello again,

I responded last time on your earlier post about AAMRQ. I know that AAMRQ holders are the last priority to pay in shares behind creditors, etc. However, I heard that AAMRQ holders will get 3.5 % initially then will be paid in shares after 30, 60, 90, and 120 day post-merger depending on if the creditors have been paid off. My question is, is it the price of LCC on the day of the merger that decides the value or AAMRQ, or will the value of the new merged company 30, 60, 90 and 120 days after the merger play a factor?

Respectfully,

Andrew

Hi Andrew,

Does the source of your distribution calendar information mention that at all?

I was refereeing to this article:

http://seekingalpha.com/article/1603302-amr-corporation-is-a-bargain

It mentions that holders of AAMRQ will be given interests in the new AAG that will be paid for in shares at 30, 60, 90, and 120 days (based on the plan of reorganization). I just want to know if they it is the price of LCC at the time of the merger that decides the conversion rate or the price of the new company 30, 60, 90, and 120 days. I am pretty sure the first one though. Also, I actually already sold most of my shares at $6.00, but with the price of AAMRQ being 5.81 and LCC 18.82, I am considering re-investing back into AAMRQ. Do you know when the last day to invest in AAMRQ is? I am assuming anytime prior to the merger date before they freeze trading, correct? As long as I invest soon, I should still be given some ownership in AAG right?

Hi Andrew,

Sorry for the long delay in response. AAMRQ holders will receive the 3.5% of the new company on the effective date of the merger. The value above the 3.5% will be distributed according to the schedule you quoted. As I understand, the value of the total distribution is fixed by the final stock price of LCC. From the Effective Date on, LCC shares will cease to exist.

The last day to buy or sell AAMRQ is the last day before the Effective Date which has now been delayed by the antitrust lawsuit from the Department of Justice. If you are interested in buying AAMRQ to be converted to AAG shares, you can still do it. Hope that helps.

Andrew,

Great analysis. I did some quick math without the proforma number you were discussing with Bill in the above posts. I think this would serve as ‘low side’ estimate.

LCC has 192.02 shares and will receive 28% after the merger.

LCC shares = 192.02/28% = 685.7 (~7% lower than the proforma numbers used)

Using this, here is the new math:

LCC price: X

LCC shares oustanding: 685.7 Million

AAMRQ liabilities to creditors and employees: $7.565 billion, or $7,565 million

AAMRQ shares outstanding: $335.3 million

Again, dropping the millions:

The value of LCC is 685.7*X

The portion allocated to AAMRQ is 72%*685.7*X=493.76*X

The leftover for AAMRQ shareholders is 493.76*X-7699 (Using updated debt figures)

Value per AAMRQ share is (493.76*X-7699)/335.3

AAMRQ stock price = 1.47(x) – 22.96

When you insert the current price of LCC:

AAMRQ price = 1.47*18.89 – 22.96 = $4.80

Of course this math takes updated debt figures and calculates shares distributed to LCC through current numbers and the 28% distribution. I would say this is a much more conservative valuation. But as you can see, AAMRQ is still on sale roughly 0.90. I would say this is still a result of the recent suit filed by DOJ. Hope this helps everyone!

Nick

Sorry, I meant to address the above message to you, Richard.

Thanks, Nick.

If you use your estimated number of AAG shares to estimate AAMRQ, you will come up with results that are not very close to reality before the Department of Justice filed the antitrust lawsuit against the merger. The discount factor on AAMRQ right now is a lot higher than 0.9 as a result of uncertainty. At the ongoing LCC price, AAMRQ was priced at more than $6 per share. $3.9 per share as of today represents a higher than 50% discount.

Hitting $ 7 a share today…to sell or not to sell?!?!

I had a conditional sale set-up at $ 7,50 a share when it dived a few months ago after hitting $7,12 briefly… not sure IF & WHEN the merger happens it will go up even more….bought at $ 0,40 🙂

Thanks for the good site!

cheers

Bo

Aamrq or amr corp. will guaranteed, hit 25.00 a share pre-merger. Because lcc should hit 30.00 on merger going thru officially. Which it will, I guarantee it!

Then, post merger, value of shares of amr corp. will be valued at 25.00 per share equivalent, and should hit 40-50.00 by end of 2014.

Again, I guarantee it!

Richard,

Does the formula of {AAMRQ= LCC x 1.582 – $22.56} carry on no matter the price of LCC? In other words, everyone is speculating LCC will be between $25 and $30 at time of merger, and even higher after that. So if LCC is at $30 at time of merger, I could get $24.90 for each share of AAMRQ that I hold?

Doug,

Why do you think it would not?

Richard,

Any thoughts on the approaching settlement/trial date vs. LCC/AAMRQ price?

Bruce

Bruce,

It is to anyone’s guess what the final stock prices will be. The actual value of the debt outstanding is yet to be finalized, and how much the airport slots are sold for will also factor in. But the final prices are not likely to deviate much if at all from this week’s range.

Hi Richard.

Thanks for posting the best analysis of the AAMRQ and LCC merger I have been able to find. I wish I had found it before the day of the announced agreement between DOJ and the airlines. I would have done a little less momentum trading in and out of AAMRQ if I had seen your analysis earlier.

I have several questions for you. Are you certain there is not an upper limit on the potential percentage of shares in the new AAG to be issued to the shareholders of AAMRQ? Terry Maxon of the Dallas Morning News posted an article on Aug 9, 2013 presenting some results of an analysis by AMR’s financial advisor, Rothschild Inc. (http://aviationblog.dallasnews.com/2013/08/it-looks-like-that-11-billion-merger-between-american-airlines-and-us-airways-is-now-a-14-billion-deal.html/?nclick_check=1). He claimed a $14 price for LCC would result in 3.5% of AAG shares going to AAMRQ shareholders, an $18 price for LCC would translate to 14.1% and a $20 price would translate to 19.9%. The Rothschild analysis put a $2.96 billion value on the shares of AAG to be distributed to AAMRQ shareholders. $2960 million/ 335.6 million shares = $8.82/share. This value is in agreement with your estimates $8.68 and 9.08 for a $20 LCC price. Also is it possible some AAMRQ creditors like the pension plans and unions would get an increased percentage of shares in the new company as the price of LCC increases? Finally, why would JP Morgan downgrade AAMRQ to neutral with a price target of $10.50 just days before the announcement of the agreement between the DOJ and the two airlines? I made some extra money by buying another 1000 shares of AAMRQ during the dip following the downgrade because I thought there might be some chicanery afoot.

Hi mexicanfoodfreak,

Since I do not have access to the aforementioned Rothschild Inc. analysis, I cannot offer comments directly. With that said, I do believe there is an upper limit on the absolute AAMRQ price because, I’m sure you can tell already, LCC price is not free to vary. At this point, both LCC and AAMRQ are tied to the new entity. LCC should be valued according to the estimated market value of the resultant airlines, AAG. According to the terms of the merger, LCC shareholders are entitled to 28% of equity in AAG. The market value of future AAG stock is total equity minus total debt, and both these amounts can change between now and when the deal closes.

AMR Corporation’s debt does not grow with stock price; in general, debtors are entitled to principal and interest, and nothing else – in exchange for its secured nature. Shares are not secured, and therefore have both upside potential and downside potential.

JP Morgan is free to upgrade or downgrade stocks as they wish. Whether this movement just happened to be days before the settlement announcement is to anyone’s guess; I don’t like to make claims without evidence, even though I have my own interpretation. As far as I know, JP Morgan’s price target had some probability of a settlement built in, and as of now, that probability is 100%. Whether they will announce a new price target because of this is also to anyone’s guess.

I hope that helps.

Hi Richard.

I apologize to you as host of this blog and JP Morgan for my poorly worded comment on the possible motivation behind JP Morgan’s downgrade of AAMRQ stock when I have no supporting facts to justify the use of words like chicanery. What I should have said is I believe a downgrade by a single major provider of investment advice appears to sometimes be a good opportunity to examine the fundamentals of the downgraded firm and try to determine if investors may be over reacting to the downgrade. Then the analysis is similar to weighing the likelihood of different outcomes, past government actions, political influences and the potential risks and rewards just like I did after the announcement of the DOJ’s decision to go to court to try to block the merger. I think the banking crisis and personal experience with investment advice gives me reasons to be skeptical but not to carelessly make unsupported statements. (Just before the Savings and Loan Crisis, I asked a broker at a major full-service brokerage to recommend a “conservative investment” for some call option profits. The response, we have a new issue preferred stock in XXX Savings and Loan and it is available without a commission. Turned out not to be very conservative. I later read an article in a Boston newspaper claiming some stock brokerage firms assigned quotas to brokers for lightly subscribed IPOs. The author then asked if you were a broker with doubts about the IPO, to meet your quota would you try to sell it to someone with a smaller account or one of your larger accounts?)

My question about whether there was an upper limit to the percentage of shares of the new AAG stock to be distributed to shareholders of AAMRQ was not very clear. If I assume an extreme case where the price of LCC stock approaches an infinite value, the percentage of stock owed to creditors would approach a limit of zero, leaving a maximum limit of 72% of stock in the new AAG available for shareholders. I was trying to ask if the merger agreement or some bankruptcy court decision would limit the percentage of shares of the new AAG stock distributed to shareholders of AAMRQ to a figure such as 20% or 25%. However, such a cap would not make sense if the shareholders of LCC get no more than 28% of the shares of the new AAG (1 share of the new AAG per share of LCC) and the creditors are limited to a fixed dollar recovery.

If the creditors are to receive shares of the new AAG with a value equal to the value of the debts they hold, it would seem reasonable for them to try to negotiate to receive more equity as the value of the shares of LCC increase to compensate them for the increased risk of owning stock instead of a promise to be paid a set dollar amount. Stocks are liquid, but if a large percentage of the creditors decide they want to sell their stock all at once, the price of the stock would undoubtedly decline, leaving many of them with less money than they were owed. If they refused to accept equity in place of cash, AAMRQ could be forced out of business and their recovery would likely be worse in a liquidation of AAMRQ assets.

Hi mexicanfoodfreak,

Creditors are in no position to negotiate. They are entitled to principal and interest only, and they are made whole before any equity would be distributed to AAMRQ shareholders. They have the option of selling the shares at market price to be paid back 100%, which is already a good deal given they could have received nothing from a bankruptcy. If they choose to hold the shares, that’s their choice. Once the new airlines pay back an equivalent amount in equities, they have no further liability to these creditors. During the deal negotiation, creditors voiced their opinions and already accepted the terms by which they would accept equities as debt payment.

Regarding your other question, well, if LCC approaches infinity, then the new airlines’ stock price will also approach infinity, and AAMRQ will also approach infinity. Wouldn’t we love this to happen!

Yes, but I would be satisfied if LCC begins to approach $32.60 a more realistic valuation. LCC is currently part of S&P’s Platinum Portfolio with a 5 Star Stars rating and a 5 fair value ranking and a fair value price of $32.60. At this price, the $28.61 share price for AAMRQ resulting from your formula would be fantastic. Any idea why AAMRQ is currently trading at a 26% discount to the price predicted by your formula?

Realistically, LCC is unlikely to get quite near that level. Haven’t read that Platinum Portfolio thing, but I assume the merger is going to change several assumptions used in setting the LCC price target, if not change it completely. The discount to the estimated AAMRQ is probably the result of uncertainty and volatility. It takes a few days for the market to understand what is going on and put a fair value on the stocks, and in the meantime early buyers have started to take profits off the table. When a stock doubles in just a couple of months this usually happens. Compared to 100% return or more that has already happened, 30% doesn’t sound appealing enough to risk a downturn.

Hi Richard,

I mentioned awhile back that I had sold most of my shares at $6. I recently bought back in at $9 (took a share cut of course) once the possibility of the merger was becoming more likely. Now that the merger is definite, I plan on holding these shares through the process. How much impact do you think the DOJ settlement and agreement to give up slots to other airlines will have on the equation for share conversion?

Also, lets say worst case scenario the newly merged airline actually drops in value significantly after the merger date. Since we are going to be paid in shares for 120 days after the merge date, am I correct in assuming we have no way to sell these shares until this is complete?

Thanks in advance for your thoughts.

Respectfully,

Andrew Clark

Andrew,

Think about it. Does the DOJ settlement have an impact on the variables in my equation?

From what I’ve learned, shares distributed to AAMRQ holders are preferred shares and cannot be sold until the end of the distribution period.

I think you meant to say restricted shares instead of preferred shares. The initial shares of AAL I received based on my positions in AAMRQ have been added to the shares distributed for my shares in LCC (just took several days longer). This is true in accounts at Schwab and TD Ameritrade. I have not tried to sell any shares, so I can’t guarantee some of my shares are not classified as restricted. It would make more sense if shares awarded to senior employees were restricted because these shares are essentially a reward for bringing the merger to fruition.

Richard,

Thanks for the reply! I just wanted to make sure I didn’t miss something since the price of AAMRQ is trading relatively low even though the merger is a sure thing. One last question (again just to make sure I understand) on the effective date of the merger the price of LCC is fixed and that determines the dollar value of shares we get. Lets say I have 20 K value due to me–at 30, 60, 90 days etc. are we technically “buying” AAL at that price in time or is that fixed as well? (ie: 5K/AAL@30days, 5K/AAL@60days, 5K/AAL@90days, etc. OR is it 20K@ day 0 = X shares of AAL, with X/4@30days, X/4@60days, X/4@90days, etc.)

Again sorry for my ignorance, I just want to make sure I understand this 100%.

Thanks in advance!

Respectfully,

Andrew Clark

Andrew,

As I have mentioned in the older post, the conversion is fixed at deal closing date regardless of the distribution scheme. If you find evidence otherwise, you’re welcome to post. I know it’s hard to be 100% confident about your judgement when you have so much at stake. My original posts were the result of my carefully reading all the sources I could get my hands on as evident from my links and quotations, and I trust my own research. To be 100% confident you may want to do some research on your own. That’s the beauty of investment research 😉

Good luck,

Richard

Why is American dropping so rapidly today? (Dec. 3)?

Predictably, because LCC fell.

Maybe what Manteo means is if you use LCC’s price in your earlier formula, AAMRQ should be priced quite a bit higher. One guess is people want to realize their gains now. Individual investors want cash near the holidays. Insiders want to redeem a small portion of the shares they’ve held so long. Institutional investors sell in December to make their fund’s 2013 return look good.

I’d love to hear a quick follow-up on the July follow-up, since so much has changed.

Request granted!

Richard,

I’m happy to have found your help here. I saw yesterday American announced for conversion information that LCC valuation had been made, I think on Monday.(2 Dec) It was about $23.50 using a 20 day average. Do you have any idea where this comes in to play? I’ve been hearing that the conversion was based on closing day of LCC. This makes it sound that it’s been done. That would make sense to have it done before the last week of LCC trading so the profit taking skew the proper valuation of LCC.. and hence AAMRQ. And by hanging in there for the conversion, are we locked in at the AAMRQ valuation using your and Jamie Baker’s formula 1.582 x LCC – 22.95? I’d prefer it to be based on a $23.50 LCC than after the blood bath of this week! Or will be getting shares of AAL 20% at a time at 0,30,60,90 and 120. The AAL employees(I’m one) will be getting shares approximately 50% at day 0 and most of the rest at day 120. Lots of questions I know. I think long term AAL shares will rise due to huge profits,and a rising P/E on par with DAL,UAL.

So with that LCC 20 day average of $23.50, is that essentially a floor to get the equivalent value of AAMRQ. That would put AAMRQ value at $14.21. A nice premium to the $10.15 or so today.

Hi Roger,

As you may have realized by now, that 20-day average serves as nothing other than an estimate of future stock price, and quite an unreliable estimate at that given you “stable” the stock market is these days 😉

The only thing locked in on the first day of merger was the the initial distribution. The rest of the AAL equity distribution to AAMRQ shareholders happens in the next 120 days or so with tons of variables in play, primarily AAL stock price and the actual amount of claims paid.

Thanks.. I did enjoy watching the gnashing of teeth for the investors who THOUGHT that the .0665 distribution was IT !!! That, no doubt would have been disturbing to someone who had bought AAMRQ the week before at 10 and now it’s worth a Buck!

Basically, we have to wait patiently for the next 120 days and watch our brokerage accounts every 30 days to see how many shares of AAL we now have. And THAT will be THAT. No reason to get panties in a wad folks. You can hope though, that AAL remains strong through out the period. Barring terrible events that we should expect from D.C., I feel the future is bright. 95% of the pilots from the AA side are certainly excited about the changes. I was in the training yesterday and you could hear the song being sung from the Wizard of Oz..”Ding Dong, the witch is dead!” Out with the old and in with the new. Parker and Co., really need to get off on the right foot early. Their predecessors blew it when they had their opportunities to change the culture.

I hope everyone does well with their AAMRQ / AAL. I feel we’re in a good place… Now take a deep breath and relax. Just don’t count those chickens before they’re hatched. That will be every 30 days for the next month.